FREE ESTATE PLANNING ARTICLES, FULL-LENGTH VIDEOS AND BLOGS!!

Recent Articles

- Protected: CONSERVATION EASEMENTS CAN SAVE THE FAMILY FARM OR RANCH

- Protected: Section 2032A Valuation Discounts May Save the Family Farm or Ranch

- Protected: Section 6166 Deferral of Estate Taxes Related To A Closely Held Business

- THE ZERO ESTATE TAX PLAN AND THE TESTAMENTARY CHARITABLE LEAD ANNUITY TRUST

- CHARITABLE IRA

- Protected: GRANTOR TRUST

- Protected: SALE OF A MINORITY INTEREST IN S CORPORATION STOCK TO A GRANTOR TRUST

- CHARITABLE REMAINDER TRUSTS

Life Insurance Review for Professionals

Policy Enhancement Services is a division of EBS Responsible Wealth focused on helping other professionals reach their clients’ goals. We believe the greatest benefits and best results for a client can be obtained from an approach that enlists the assistance of a variety of advisers. Policy Enhancement Services can play an important role on the estate planning team because we can evaluate and enhance your client’s life insurance products. When properly structured, life insurance will provide the estate with the necessary cash to pay the estate tax. Life insurance can also be used to fund other liabilities as well as to fund the income needs of the surviving family.

Because of current low interest rates and a volatile investment climate, many life insurance policies sold in the last two decades have not performed as shown in the original sales illustration. If left unattended, many life insurance policies will lapse. What is most disturbing is that many insureds, owners, trustees, and professional advisers are unaware of this.

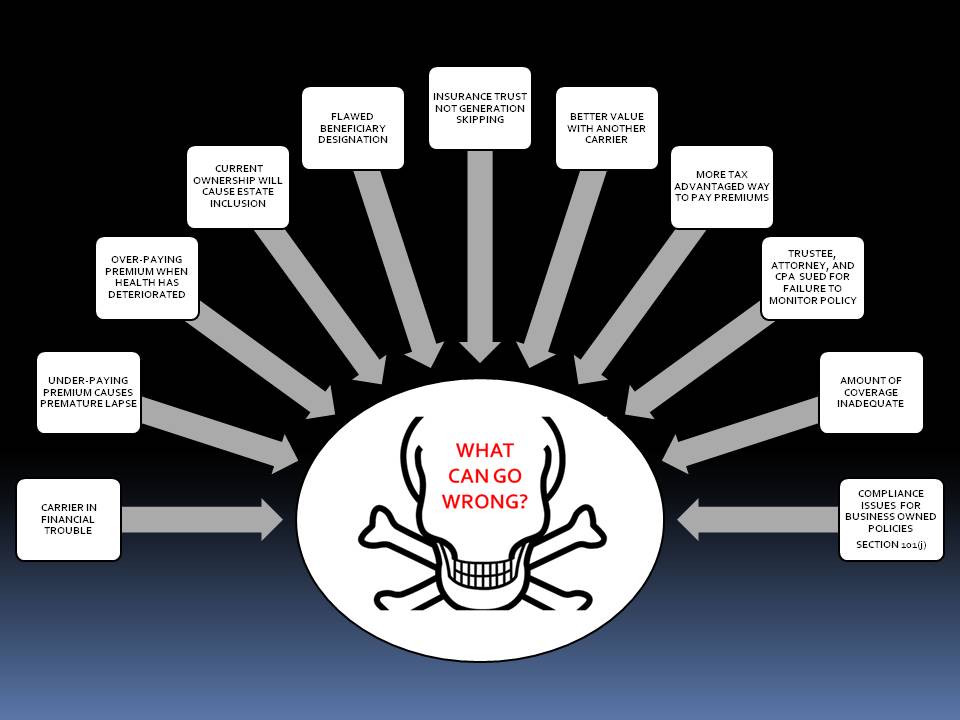

What Can Go Wrong With Your Clients’ Existing Life Insurance Policies?

What Can Cause Life Insurance Proceeds To Be Included In The Estate?

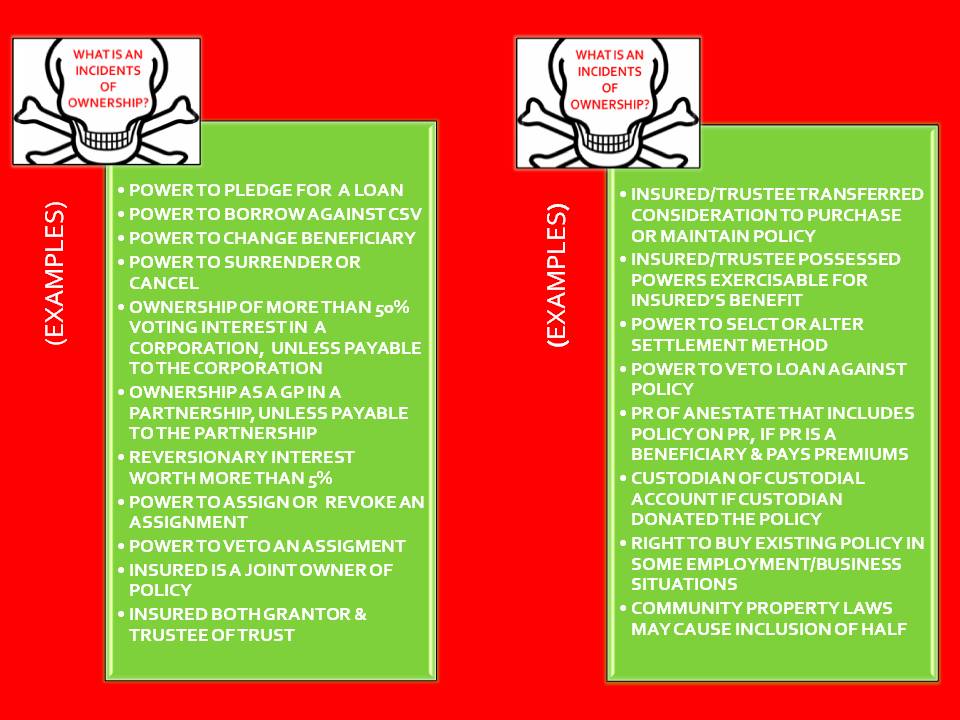

What is an Incidents of Ownership?

To appreciate the significance of a thorough policy performance evaluation, please watch the following videos on this page where we highlight several case studies, of real client situations, where we were able to deliver value that the client was not experiencing. In these real case studies, we added value by helping the client understand that their existing policy is underperforming and what adjustments are necessary to prevent a lapse, or by helping the client acquire a policy with better guarantees, or by helping the client acquire a policy with lower premiums.

Life Insurance Review Case Study #1

Life Insurance Review Case Study #2

Life Insurance Review Case Study #3

Life Insurance Review Case Study #4

Life Insurance Review Case Study #5

PES Life Insurance Review Process

Trustees and Fiduciaries Governed By The Uniform Prudent Investor Act – UPIA

The primary role of a life insurance trustee is to maximize the value of the TOLI policy held in an irrevocable Life Insurance Trust ( ILIT ) for which it has management responsibility. Sometimes that duty calls for the replacement of an existing life insurance policy for one that is more appropriate and provides greater value to the trust beneficiaries.

For those professional trustees governed by The Uniform Prudent Investor Act ( UPIA ) there may be a fiduciary responsibility to monitor all assets, including life insurance, to ensure continued suitability for the specific trust goals. The professional trustee should have a process in place to review the trust owned policies and that monitoring should be well documented.

The non-professional trustee of an irrevocable life insurance trust should adopt a deliberate monitoring process as well. Improper policy administration may subject the trustee to scrutiny, criticism, and maybe even legal liability. Proper review of a complicated asset like a life insurance policy by a non-professional trustee is frequently lacking and may cause the policy to underperform and not provide the expected result.

The life insurance industry has undergone a transformation over the past two decades. Lower mortality charges, cost efficiencies, special riders, aggressive underwriting, competitive pressures, more sophisticated agents, more sophisticated consumers, and access to capital markets have allowed insurance companies to create new life insurance products that may provide a better value than years past.

While price is important, fiduciaries must be aware of potential disadvantages when considering the replacement of a permanent life insurance policy with another. Below are the following disadvantages:

- The insured may have to satisfy limits in the new policy that have already been satisfied in the old policy. For example, a life insurance policy usually has a two-year “incontestable” clause. With the purchase of a new policy, that clause would begin again. The same would hold true for the “suicide” clause which is typically also two years.

- If the present policy has existing loans, the cancellation of the policy may have tax consequences.

- If you simply terminate a life insurance policy, there will be taxes due on the “gain” in the policy. Gain is defined as the difference between the amount received from the insurance carrier and the cost basis (generally the amount of premium paid). Policy loans make things worse. Such tax consequences can sometimes be mitigated with the use of a Section 1035 exchange.

- Older policies, issued prior to June 21, 1988, are not subject to the rules governing Modified Endowment Contracts (MEC).

- In those situations where cash values are important, be aware that the cash values in a newly purchased policy may be less than in the replaced policy. New life insurance policies contain new sales and acquisition costs, and new surrender charges. At any point in time the values may be more or less than what the values could have been in the replaced policy.

Life insurance sales illustrations contain both guaranteed and non-guaranteed elements. If you are considering the replacement of an existing policy with a new policy based on a sales illustration that relies on “current assumptions” (which are not guaranteed), be aware that the policy’s non-guaranteed elements are only projections (not predictions) of interest rates, investment returns, and mortality and cost assumptions that may or may not materialize.

On the other hand, if you are considering the replacement of an existing policy with a new policy based on a sales illustration that relies on “guaranteed values”, understand that the policy guarantees are only as strong as the carrier backing them.

OUR TOLI POLICY REVIEW SERVICE

We are pleased to offer a TOLI policy review service, free of charge, for professionals. It is designed to compare the “actual” performance of any existing policy to what was expected when the policy was originally purchased. If a policy is not performing as anticipated, we can help you identify solutions designed to improve the situation.

It begins with an In-Force Illustration on the existing policy using the original planned premium schedule. An in-force Illustration is different from an annual statement. An annual statement is a snap-shot of a policy’s performance. An in-force illustration is a “re-projection” of the values of a permanent life insurance policy that is already in-force. It uses a policy’s cash values as of the date of the “in-force” illustration and then projects values into the future based on premium levels and other variables. It is a way to analyze the performance of a policy versus the original projection. The effect on the policy of changing the premium amount, timing, and death benefit, etc., can be analyzed.

If the original planned premium schedule is no longer projected to be sufficient to meet the policy goals, we will help determine a premium schedule to “right” the current policy. We will then compare the existing “righted” policy to alternative newer policies that may be more efficient. If a new policy appears to be the better option, we will help you through the underwriting process to obtain a new policy.

There are a number of very valid reasons why a new policy may be a better choice than an older existing policy. Here are a few:

Newer Policies May Have Lower Costs-

Many of the newer policies available today have cost structures that are lower than policies issued just a few years ago. Carriers tend not to pass these cost savings on to the existing policyholders – so those who wish to take advantage of the new lower costs may need to purchase new, more efficient policies.

Changes In Underwriting Of The Insured-

Sometimes, an insured person may have favorable changes in health that might affect the cost structure of the policy.

Underwriting Opportunities-

Special underwriting programs and promotions which “shave” undesirable ratings off normal underwriting offers may become available. These may reduce the mortality costs within the policy.

Carrier Financial Difficulties-

If the financial stability of an insurer changes, it may be prudent to move to a more financially solvent company.

All illustrations show a non-guaranteed assumed projection and a guaranteed projection. The non-guaranteed assumed projection is a “best guess” of what will occur in the policy going forward using the current assumptions for expenses, mortality charges and investment returns. The guaranteed projection uses only those factors that are guaranteed when it projects the outcome.

There Are A Number Of Factors That May Affect The Performance Of Existing Permanent Life Insurance Policies, Especially Those That Rely On Non-Guaranteed Current Assumptions

First, is that premiums may not have been paid, paid late, or in amounts different than originally planned. Second, is the interest rate return on the underlying investment that provides the cash value in the policy. In Universal Life Insurance (UL) and Whole Life Insurance (WL) policies this investment account is in Insurance Company-directed investments. In Variable Life Insurance policies the cash value is invested in separate accounts with the asset classes chosen by the policyowner. Third, are the actual expenses and mortality charges. The factor that most affects the actual performance of the policy (besides the premiums paid) versus that projected in the original sales illustration is the interest rate. Future expenses and mortality charges used in original illustrations are easier to project and predict than the investment return. If the actual interest rate achieved is less than the projected rate, the policy will not perform as well as expected.

How Have Actual Interest Rates and Investment Returns Affected The Expected Performance Of Older Existing Policies?

Over the last twenty or so years, the interest rates on UL policies have dropped. In the 1980s, the market interest rate was almost 12% when some policies were introduced. We all know how much interest rates have dropped since then. Equity markets have dropped and been erratic over the past ten years; which has an impact on policy performance for Variable Life policies. The drag caused by lower returns in a life insurance policy presents itself in actual cash values lower than the original illustrated values. For those policies that were purchased based on non-guaranteed projected premiums, poor investment performance can cause a policy to lapse unless a higher premium is paid.

How Improvements In Mortality Are Reflected In Existing Life Insurance Policies?

Over the last 10 to 15 years, both expenses and mortality costs for life insurance policies have dropped. Improvements to the mortality costs in the life insurance marketplace are typically not passed on to existing policies. Due to competitive pressures many insurers use the mortality gains that are created in older policies to lower costs on new product offerings to attract more new business.

The Evolution of Life Insurance

The life insurance industry has evolved quite a bit since the 1960s, where there were just a few simple forms of life insurance products. That all started to change in the early 1980s with the creation of Universal Life Insurance. Coincidentally, at the same time Universal Life started to hit the market, the US was experiencing its highest inflationary period ever. Illustrations were presented to the public with rates of 12% or higher, in a world where economists thought we would never see inflation in the 2-3% range again. Illustrations that were presented at 8-10% interest rates were considered conservative. Universal Life shifts some of the risk in maintaining the death benefit to the policyholder. Premium payments are flexible. This premium payment flexibility allows policyholders to maintain, increase, or decrease their death benefit based on current market trends and personal needs. While these products contain guaranteed interest rates and expenses, most buying decisions were based upon non-guaranteed elements.

In the late 1980s and early 1990s Variable Universal Life was starting to hit the market. Variable Universal Life shifted even more risk to the policyholder. Not only did the consumer have flexibility in regards to the payment of premiums, they also controlled where the policy cash values were invested; typically in equities. The theory was to allow consumers more upside potential. But, there was also big downside potential. Unlike recent years, the market performed well during the 1990s. Variable life illustrations were frequently presented showing 12% rates of return. Traditional Universal Life illustrations presented interest rates that were much higher than today. It is the same with Whole Life policies. Because of these unsustainable assumptions, many policies sold in the late 90s and early 2000s are in serious danger of lapsing much earlier than projected in the original sales illustration.

Wherever you are located, email us at info@ebsresponsiblewealth.com to arrange for a free

consultation.

Internal Revenue Service Circular 230 Disclosure

Pursuant to Internal Revenue Service Circular 230, we hereby inform you that any tax advice set forth herein with respect to U.S. federal tax issues was not intended or written by E. Brian Singer, Shaun Singer, EBS Group, EBS Responsible Wealth, or EBS Business & Investment Group, Inc., to be used, and cannot be used, by you or any taxpayer, for the purpose of avoiding any penalties that may be imposed on you or any other person under the Internal Revenue Code.

Copyright 2011 © EBS Responsible Wealth