FREE ESTATE PLANNING ARTICLES, FULL-LENGTH VIDEOS AND BLOGS!!

Recent Articles

- Protected: CONSERVATION EASEMENTS CAN SAVE THE FAMILY FARM OR RANCH

- Protected: Section 2032A Valuation Discounts May Save the Family Farm or Ranch

- Protected: Section 6166 Deferral of Estate Taxes Related To A Closely Held Business

- THE ZERO ESTATE TAX PLAN AND THE TESTAMENTARY CHARITABLE LEAD ANNUITY TRUST

- CHARITABLE IRA

- Protected: GRANTOR TRUST

- Protected: SALE OF A MINORITY INTEREST IN S CORPORATION STOCK TO A GRANTOR TRUST

- CHARITABLE REMAINDER TRUSTS

Estate Planning and Gift Tax Planning

The estate tax is sometimes referred to by politicians as the Death Tax or the Inheritance Tax. The words Death Tax and Inheritance Tax are not found anywhere in the law. The proper terminology is the Estate Tax. Politicians use the words Death Tax and Inheritance Tax because it hits a chord with people, even from those who will never pay a cent in estate tax. Only a very small percentage of people will ever be subject to the estate tax. For the very wealthy, the estate tax can be significant, but it does not have to be that way. There are many opportunities to substantially reduce the ultimate estate tax bill, and in some cases eliminate the estate tax completely. The only way, however, is to put the emotions off to the side and approach the problem like any other business problem; by having a logical, intelligent, and nuanced discussion with people who know what they are doing. Please see our Why Work with Us and Bio pages.

There is no “silver bullet” that can simultaneously reduce your estate tax liability to nothing, while at the same time provide everything to your family immediately following your death. However, there are important steps that can be taken to reduce the estate tax liability without unreasonably infringing on your access to assets during your lifetime, or the ability of your family to inherit the substantial portion of your estate. Through a variety of steps, some large and some small, some to be taken immediately and some over time, we can help substantially reduce your estate tax liability.

There are three possible beneficiaries of your estate:

- The people you care about

- Your favorite charities, and

- The IRS

With proper estate planning, you get to choose two of them. Most people, given the choice, prefer to eliminate the IRS. The problem is that many people are never offered the choice. Consequently, the IRS becomes a primary beneficiary of the estate. We are offering you the choice!

This is how you reduce the estate tax…

- Die with fewer assets using gifting and other wealth shifting techniques.

- Structure ownership so that the remaining assets are valued at a discount when you die.

- Leave assets to charity either outright or using available planned giving strategies.

- Arrange for a life insurance company to pay the tax for you with funds that are not themselves subject to estate tax.

Most estate planning solutions fall into one or more of the above categories. Instead of voluntarily offering your assets to the IRS, you can choose to implement one or more of the many estate tax planning techniques that will put more money in the pockets of the people and charities you care about. Our job is to explain these estate planning strategies in a way you can understand.

We routinely use a combination of estate tax planning techniques with clients. A sampling of techniques and concepts includes:

- Maximization of the Annual Gift Tax Exclusion

- Maximization of the Gift Tax Unified Credit Exemption

- Maximizing the Benefits of Taxable Gifts

- Grantor Trust

- Family Partnership Valuation Discounts

- S Corporation Valuation Discounts

- Grantor Retained Annuity Trust – GRAT

- Qualified Personal Residence Trust – QPRT

- House LLC Grantor Retained Annuity Trust

- House LLC Sale to Grantor Trust

- Sale of Family Partnership Interests to a Grantor Trust

- Sale of a Minority Interest in an S Corp to a Grantor Trust

- Charitable IRA

- Zero Estate Tax Plan and the Testamentary Charitable Lead Trust

- Charitable Remainder Trust

- Deferral of Estate Tax Under Section 6166

- Stock Redemption Under Section 303

- Valuation Discounts for Farmer and Ranchers Under Section 2032A

- Conservation Easement

- Crummey Trust and Crummey Powers

- Life Insurance to Pay Estate Tax

- Private Split Dollar Life Insurance

- Private Annuities

- Self Cancelling Installment Note – SCIN

- Lifetime Charitable Lead Trust

- Charitable Gift of Life Insurance

- QTIP Trust

- Credit Shelter Trust

- Qualified Domestic Order Trust for the Non-Citizen Spouse

It would be easy to do estate planning if you knew when you are going to die, but you don’t. Many of the best estate planning techniques gradually move assets out of the estate over a period of years. It is costing your family money for every day that you delay. You are losing the opportunity to move assets to the non-taxable side of the ledger. We have been involved in a number of sad situations where people did not move fast enough to reduce the estate tax bite and ran out of time.

There is yet another reason to get moving on your estate planning now. As you age, your ability to grasp concepts will diminish. The time to make estate planning decisions is when you are at your sharpest, which is now. You will never be sharper than you are today.

There is so much money on the table and it is just there for your taking. If you don’t claim it for your family, the government will claim it. You can make more money tackling your estate planning than you can by trying to make more money. Nothing you can do will yield greater results with so little effort.

Contemplate this…What will happen to your home? What will happen to your investments? What will happen to your business? What will happen to your commercial real estate holdings? What will happen to your farm or ranch? We can tell you… assets are likely to be sold to pay estate tax. Is that what you want?

Responsible Wealth means taking estate planning very seriously and doing the best you can for your family and favorite charities. Your family is relying on you. It is likely difficult for them to talk to you about it. You only die once and therefore you have only one shot at getting your estate tax planning right. If you get your estate planning situation squared away, you will relish in the satisfaction that your life’s financial accomplishments will live on. When your estate is settled, it will be obvious to everyone just how much you loved them. Do not blow it! You did not come this far to be careless at the finish line.

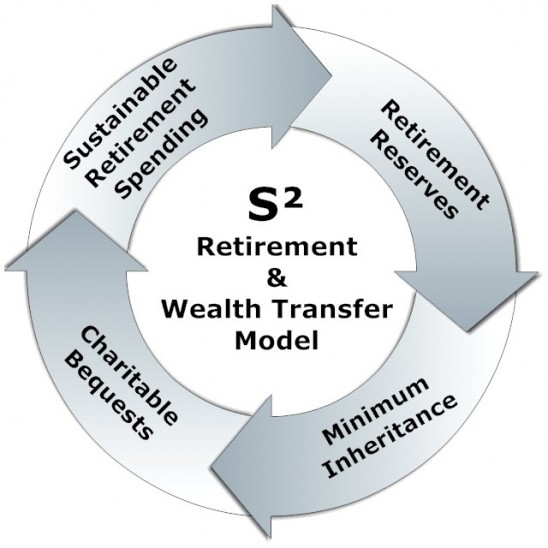

The S2 Model – “It’s About Thinking Dollars; Not Taxes”

Estate planning is about achieving goals. The estate tax is merely an obstacle to achieving your goals. We believe that you should be thinking dollars, not taxes. The S2 Model can allow you to maintain your financial security while alive and to leave a meaningful inheritance when you die. The S2 Model is a way of looking at things. It provides a perspective most people can understand. It focuses on goals and the dollars required to achieve those goals, rather than taxes. Visit our Estate Planning and Gift Tax Planning page to read more about the simplicity and practicality of the S2 Model.

• Works whether or not your estate is very large or small

• You do not lose access to your money

• You do not lose control over your money

• You do not tie up your money

• Focus is on dollars; not estate tax

• Cuts out most expensive legal and accounting fees

• Can be changed at any time up until your death

• Works even if the estate tax is ever eliminated

• Works in both the short term and long term

There are three distinct asset buckets to the S2 Model. You can start wherever you want because each segment is dependent on the other.

Our approach would typically begin with the Financial Nut. Using realistic assumptions about life expectancy, a conservative rate of return, and informed assumptions about taxes, we compute how much of your net worth will be required to fund your Financial Nut. For example, let’s assume a married couple, both age 70, with an $8,000,000 net worth. We might compute how much is required to cover after tax living expenses of $150,000/yr, adjusted for inflation, to age 100, using a 3% rate of return, and a 33% tax bracket.

The next thing would be for you to decide on a Minimum Inheritance and purchase life insurance in that amount.

The last thing to compute is the Financial Backstop. We would still use conservative returns, but maybe not as conservative as the 3% return and 33% tax rate we used to compute the Financial Nut. We might use an Equity investment with an 80-100% turnover rate, a 2% dividend rate, a 3% growth rate, and a 17% tax rate. We input the insurance premium payments into the model and determine on a year by year basis the amount available as the Financial Backstop. If the Financial Backstop amount is insufficient, we reduce the insurance amount until the Financial Backstop amount is sufficient. If the Financial Backstop amount is more than required, we increase the amount of insurance.

In the end, the children will receive the Minimum Inheritance through the insurance, plus whatever other assets are left over after all taxes, including estate tax. All the taxes, including estate tax, are factored into the model but are not addressed as a separate goal. The likelihood is that the children will receive more that the Minimum Inheritance provided by the insurance. You may not need the entire amount set aside to cover your Financial Nut, or the entire amount set aside as the Financial Backstop, and/or achieve higher investment returns than the conservative assumptions used in the model.

HOW REFRESHING!

NOW JUST GO LIVE YOUR LIFE!

YOU ARE TAKEN CARE OF AND SO IS YOUR FAMILY!

NO HEADACHES!

YOU ARE FREE!

Wherever you are located, email us at info@ebsresponsiblewealth.com to arrange for a free consultation. Our common sense approach to estate planning and life insurance to pay estate tax will help you get to where you want to be.

FREE ESTATE PLANNING ARTICLES, FULL-LENGTH VIDEOS, AND BLOGS!!

Internal Revenue Service Circular 230 Disclosure

Pursuant to Internal Revenue Service Circular 230, we hereby inform you that any tax advice set forth herein with respect to U.S. federal tax issues was not intended or written by E. Brian Singer, Shaun Singer, EBS Group, EBS Responsible Wealth, or EBS Business & Investment Group, Inc., to be used, and cannot be used, by you or any taxpayer, for the purpose of avoiding any penalties that may be imposed on you or any other person under the Internal Revenue Code.

Our role is to help you evaluate planning techniques that can reduce your future estate tax and gift tax, and increase the wealth transferred to your family. Brian Singer is not an attorney. Although he is a CPA (Inactive-California), it is not his intention to become your CPA. He no longer engages in the practice of public accounting. This and any other analysis or discussion is not meant to address all the issues and risks as you might find in a technical legal analysis. That task, if necessary, and if you are willing to pay the fee, is the responsibility of your attorney. Brian Singer attempts to take complicated tax principles and reduce them to understandable techniques for the layperson, in plain English. Any discussion and/or written analysis are meant to give you an overview of the anticipated benefits to be derived by employing specific techniques. Final responsibility for the tax aspects rests with the attorney of your choosing. All techniques require careful drafting by a highly competent tax attorney with specialized knowledge. A concept that might work when competently drafted, could fail as a result of mistakes made in the documents prepared by an attorney not proficient in these areas. The appreciation rates, investment earning rates, tax rates, valuation discounts, and other factors are hypothetical assumptions. The benefits from implementing any technique will ultimately be better or worse than described depending upon variation from the assumptions. There are no guaranteed results; either in an economic analysis or in application of the tax law. We hope you will decide to use our services. Any planning we propose is incidental to the purchase of insurance. Since insurance is used to pay estate tax, the less tax you will owe, the less insurance required. The planning is essential in the determination of your insurance needs. You are in no way obligated to purchase any insurance. If it makes sense for you, then buy it; if it doesn’t make sense for you, then don’t buy it. You are not expected to do anything that you feel is not in your best interest. We may choose to disengage at any time.